IBI Group Inc. Announces Strong Q1 2022 Results, Supporting 3.5% Increase to 2022 Net Revenue Guidance

Date

May 5, 2022Download PDF

- 9.3% Organic growth

- 11% Net revenue increase

- 15.6% Adjusted EBITDA1 margin

- 2022 net revenue guidance increased to $473 million

Toronto, Ontario – May 5, 2022 – IBI Group Inc. (“IBI” or the “Company”), a globally integrated design and technology firm, today announced its financial and operating results for the three months ended March 31, 2022. Select financial and operational information is outlined below and should be read with IBI’s consolidated financial statements (“Financial Statements”) and management’s discussion and analysis (“MD&A”) as of March 31, 2022, which are available on SEDAR at www.sedar.com and on IBI’s website at www.ibigroup.com. Unless otherwise indicated, all references to Adjusted EBITDA in this release means Adjusted EBITDA net of IFRS 16 impacts.

Select First Quarter 2022 Highlights:

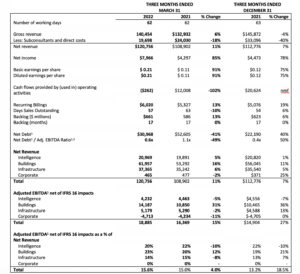

- Net revenue increased 11% to $120.8 million in Q1 2022, compared to $108.9 million for the same period in 2021, with organic growth of 9.3% or $9.9 million.

- With a strong start to 2022, the Company is pleased to raise full-year net revenue guidance to $473 million, a 3.5% increase from the prior guidance of $457 million, reflecting the impact of acquisitions coupled with ongoing organic growth.

- Adjusted EBITDA1 grew to $18.9 million (or 15.6% of net revenue) in Q1 2022, reflecting an increase of 15% over the $16.4 million (or 15.0% of net revenue) generated in the same period in 2021, and a 27% increase over Q4 2021.

- Diluted earnings per share totaled $0.21 in the first quarter, a 91% increase over $0.11 per share for the same period in 2021 and a 75% increase over the previous quarter.

- Net debt to Adjusted EBITDA1,2 multiple was 0.6 times at the end of the quarter, slightly higher than year-end 2021 as net debt increased due to the cash cost of funding acquisitions completed in the quarter along with the share buyback program.

- Backlog increased by 13% to $661 million (17 months) relative to Q1 2021 and was 6% ahead of year-end 2021.

- Recurring software support and maintenance billing to clients totaled $6.0 million in Q1 2022, an increase of 13% and 19% relative to the $5.3 million and $5.1 million in Q1 2021 and Q4 2021, respectively. The majority of the increase is attributable to organic growth in recurring revenue services along with contributions from the Telenium acquisition which closed in late 2021.

- Days sales outstanding (“DSO”) at quarter end totaled 57 days and was six days, or 10%, lower than Q1 2021, three days higher than year-end 2021, and in line with IBI’s expectations for collections going forward.

- At the end of the quarter, IBI closed the acquisition of Florida-based RLC Architects (“RLC”), expanding the Company’s US presence, particularly in logistics and supply chain services and Florida’s residential building segment.

- IBI’s new strategic direction will be introduced at the AGM with a full showcase of the Company’s Strategic Plan to be held September 22, 2022 at an in-person event hosted in IBI’s Sandbox, which will facilitate a rich and fulsome strategic update while enabling the Company to showcase its business units, people and projects.

Financial Highlights

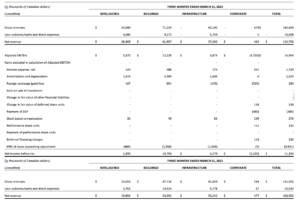

(in thousands of Canadian dollars except per share amounts or where otherwise indicated)

2022 Off to a Strong Start

During the first quarter of 2022, IBI continued to build on the momentum generated in 2021 with all three business sectors – Intelligence, Buildings and Infrastructure – contributing to an 11% increase in net revenue year over year while the Company successfully generated 9.3% organic growth.

The Company’s Adjusted EBITDA1 net of IFRS 16 impacts totaled $18.9 million, or 15.6% of net revenue, an increase of 15% compared to Q1 2021 and 27% over Q4 2021. Diluted earnings per share increased by 91% to $0.21 in the quarter, and the Company’s backlog further increased by 13% to $661 million (17 months) relative to the same period in 2021 and was 6% higher than at year-end 2021.

“Our performance through the first quarter of 2022 clearly demonstrates IBI’s strengths across core business lines, and was highlighted by the Company 9.3% organic growth, coupled with meaningful increases in net revenue, Adjusted EBITDA, margins and net income, both year-over-year and quarter-over-quarter, while maintaining a healthy balance sheet with net debt to Adjusted EBITDA2 of 0.6 times at the end of the quarter,” said Scott Stewart, Chief Executive Officer of IBI Group. “Given these results, coupled with a $661 million, 17-month backlog and visibility into full bookings of our Buildings sector for the balance of the year, we are very pleased to increase our net revenue guidance by 3.5% to $473 million for 2022.”

IBI’s Buildings sector generated strong performance through the quarter relative to both the same period in 2021 and the previous quarter, as rising immigration continues to drive steady demand across Canada’s core urban centres. Within the Infrastructure sector, heavy investment into public transit infrastructure contributed to net revenue growth of 6% and 5% over Q1 2021 and the previous quarter and represents a pipeline of future projects across the country, including the opportunity for IBI to continue bidding on large-scale transit expansion projects. IBI’s Intelligence sector also grew net revenue by 5% relative to the same period in 2021, while increasing recurring billings to $6.0 million, a 13% increase over Q1 2021. As a result of timing delays on revenue recognition for certain Intelligence projects undertaken during the quarter, Adjusted EBITDA1 net of IFRS 16 impacts and associated margins trended lower, which IBI anticipates reversing through the balance of 2022.

“As a technology-driven design firm, IBI leverages our core Buildings and Infrastructure sectors to create channels to market for Intelligence by applying software systems and support, particularly in mobility areas such as tolling, traffic management and traveller information systems. We will continue to invest in Intelligence products, marketing and data monetization to accelerate growth, expand margins, and increase annual recurring revenue,” said Scott Stewart.

At quarter end, the Company’s net debt was $31.0 million, 41% lower than the same period in 2021, resulting in a net debt1 to Adjusted EBITDA1 multiple of 0.6 times compared to 1.1 times in Q1 2021. Net debt increased over year end 2021 due to increases in non-cash working capital, which totaled $14.2 million for the first quarter of 2022 compared to $4.3 million for the same period in 2021. IBI typically requires and utilizes more cash within the first half of the year, which is offset by the Company being a net generator of cash in the second half. It is not unusual to realize large collections trending during the latter of portion of Q4 while payouts to subcontractors occurs in the first quarter. In addition, a number of IBI’s computer software costs are prepaid in the first quarter of the year, which causes a larger cash outflow and an increase in prepaid and other assets.

The Company continued to pursue accretive acquisition opportunities during the first quarter, culminating in the successful acquisition of Florida-based RLC. Integrating RLC’s team contributes to IBI’s architectural expertise and also complements the Company’s Michigan engineering practice, as RLC provides IBI with an expanded reach into onshore manufacturing in the auto industry as well as industrial and supply chain business lines.

As previously announced, IBI bolstered its leadership group with several key appointments within the US division, further strengthening its ability to leverage the expected growth in US infrastructure investment. Todd Hoisington assumes the title of Director, USA, in charge of all Intelligence, Buildings and Infrastructure projects south of the border. Supporting Mr. Hoisington are Leslie Young, Director, Managing Principal, Ari Bose, Director US Sector Lead, and Susan Christensen, Director, Operations USA.

Business Sector Summary Highlights

Intelligence

Net revenue from IBI’s Intelligence sector totaled $21.0 million, reflecting an increase of 5% and 1% over the same period in 2021 and the previous quarter, respectively. Recurring billings also grew to $6.0 million, representing 13% and 19% increases over Q1 2021 and Q4 2021, respectively, supported by a December 2021 asset acquisition which bolstered IBI’s SaaS portfolio and enhanced the Company’s Travel-IQTM platform. Adjusted EBITDA1 from Intelligence totaled $4.2 million, or 20% of net revenue in the first quarter of 2022, lower than the Adjusted EBITDA1 margins of 22% in both Q1, 2021 and Q4, 2021. The Intelligence sector outperformed within IBI’s Canada East segment, and recorded results that were on target in the US, however declines in solutions across western Canada, Mexico and Greece were not fully offset. IBI will continue pursuing opportunities to generate new Intelligence revenue from areas such as data collection and leveraging channels to market initiated from the Buildings and Infrastructure segments. The Company remains committed to investing in Intelligence and expanding its marketing efforts in order to resume the previous organic growth trajectory and forecasts.

During the quarter, IBI successfully integrated data from Ecosystem Informatics Inc. (“ESI”) into our Smart City Platform, which can provide clients practical information needed to build resilient, connected, and smart cities of tomorrow. This further expands IBI’s reach to certain urban municipalities and businesses around the world, such as densely populated cities in India, who are committed to making changes for a cleaner, more sustainable future. Other notable wins from IBI’s Sandbox initiatives include consulting work secured for CurbIQ in California and Ohio, along with accelerating demand for the Company’s Nspace product as more people go back to work in shared spaces.

In late January, IBI was pleased to announce additional collaborative partnerships as a part of its Smart City Sandbox initiative with the addition of multinational law firm, Dentons. Dentons’ legal expertise in privacy, technical innovation and public policy is critical to advancing larger scale municipal infrastructure projects and will be a valuable contributor to advancing new products and solutions in urban environments.

Buildings

The Company’s Buildings sector continued to post very strong results for the first quarter of 2022, as net revenue grew to $62.0 million, an increase of 16% and 11% over Q1 2021 and Q4 2021, respectively. Adjusted EBITDA1 net of IFRS 16 was similarly strong at $14.2 million or 23% of net revenue, which was 31% and 36% higher than the same period in 2021 and the previous quarter, respectively. As the Buildings sector is fully booked for the year, IBI anticipates continued healthy performance despite indications of rising interest rates.

IBI’s acquisition of Florida-based RLC expands the Company’s leadership in “green design” along with enhanced application of industrial engineering to supply chains. RCL’s 32 years of client service in Florida provides a unique opportunity to develop sustainable projects in industrial, residential, commercial, education and interior architecture sectors in the southeastern US. Through RLC, IBI gains exposure to a new suite of global clients, projects and opportunities, while also affording the Company a solid entry into the growing residential market in South Florida.

Infrastructure

Performance from IBI’s Infrastructure sector remained healthy in Q1 2022, as net revenue totaled $37.4 million, an increase of 6% and 5% over Q1 2021 and Q4 2021, respectively, while Adjusted EBITDA1 net of IFRS 16 was $5.2 million, 2% less than Q1 2021 and 13% higher than the previous quarter. As a percentage of net revenue, Adjusted EBITDA1 for Infrastructure was 14%, down modestly from 15% realized in Q1 2021 and above the 13% generated in Q4 2021.

During the first quarter, IBI successfully secured its second significant, long-term basement flooding contract with the City of Toronto as part of the City’s Basement Flooding Protection Program. Under these sizeable contracts, the Company will provide design, contract administration, engineering, and construction inspection services in the northern Etobicoke district over the next five years. Given IBI’s water management and civil engineering expertise, the Company can deliver sustainable solutions to relieve pressure on the existing sewer and water system and reduce the risk of basement flooding.

2022 Guidance and Outlook

With acquisitions to impact IBI’s performance for the balance of 2022, along with further visibility into customer demand and a strong start to organic projects, IBI is pleased to announce an increase to its prior 2022 full year net revenue guidance. Revised guidance now reflects a forecast $473 million in net revenue for the year ended December 31, 2022, a 3.5% increase from the prior guidance of $457 million. With $661 million of work committed under contract for the next five years, and a 17-month backlog, the Company is well positioned to continue delivering meaningful growth and driving compelling returns for investors.

Annual Shareholder Meeting Webcast

Following the Q1 2022 investor conference call tomorrow, May 6th, IBI will also host its virtual Annual Meeting of Shareholders at 10:00am ET, which will be conducted online using the virtual LUMI platform. Shareholders and other participants who are interested in attending may click on the following link to access the meeting: https://web.lumiagm.com/418593807. Registered shareholders and duly appointed proxyholders can follow the instructions outlined in the Company’s Information Circular to attend and vote, while guests may follow the prompts.

Following the formal part of the meeting, CEO Scott Stewart will introduce IBI’s new strategic direction during a brief presentation with a full showcase of the Company’s Strategic Plan to be provided during an in-person event planned for September 22, 2022.

1 Recurring billings, net debt, net debt to Adjusted EBITDA ratio, and Adjusted EBITDA are non-IFRS measures. Refer to the “Non-IFRS Measures” section of this press release and “Definition of Non-IFRS Measures” in the MD&A for more information on each measure and a reconciliation of Adjusted EBITDA to Net Income. Since these measures are not standard measures under IFRS, they may not be comparable to similar measures reported by other entities.

2 Adjusted EBITDA for bank covenant purposes.

Investor Conference Call & Webcast

The Company will host a conference call on Friday, May 6, 2022, at 8:30 am ET to discuss the first quarter results. IBI’s Chief Executive Officer, Scott Stewart, and Chief Financial Officer, Stephen Taylor, will present IBI’s financial and operating results followed by a question and answer session.

To listen to the live webcast of the conference call, please enter the following URL into your web browser: https://produceredition.webcasts.com/starthere.jsp?ei=1538911&tp_key=471372c54a.

Q1 2022 Conference Call Details:

Date: Friday, May 6th, 2022

Time: 8:30 am ET

Dial In: North America: 1-888-390-0546

Dial In: Toronto Local / International: 416-764-8688

Replay: North America: 1-888-390-0541

Replay: Toronto Local / International: 416-764-8677

Replay Passcode: 628894

A recording of the conference call will be available within 24 hours following the call on the Company’s website. The conference call replay will be available until May 20th, 2022.

About IBI Group Inc.

IBI Group Inc. (TSX:IBG) is a technology-driven design firm with global architecture, engineering, planning, and technology expertise spanning over 60 offices and 3,200 professionals around the world. For nearly 50 years, its dedicated professionals have helped clients create livable, sustainable, and advanced urban environments. IBI Group believes that cities thrive when designed with intelligent systems, sustainable buildings, efficient infrastructure, and a human touch. Follow IBI Group on Twitter @ibigroup and Instagram @ibi_group.

For additional information, please contact:

Stephen Taylor, CFO

IBI Group Inc.

55 St. Clair Avenue West

Toronto, ON M5V 2Y7

Tel: 416-596-1930

www.ibigroup.com

Forward-Looking Statements

Certain statements in this news release may constitute “forward-looking” statements which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company and its subsidiary entities, including IBI Group Partnership (“IBI Group”) or the industry in which they operate, to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this news release, such statements use words such as “may”, “will”, “expect”, “believe”, “plan” and other similar terminology. These statements reflect management’s current expectations regarding future events and operating performance and speak only as of the date of this news release. These forward-looking statements involve a number of risks and uncertainties, including those related to: (i) the Company’s ability to maintain profitability and manage its growth; (ii) the Company’s reliance on its key professionals; (iii) competition in the industry in which the Company operates; (iv) timely completion by the Company of projects and performance by the Company of its obligations; (v) fixed-price contracts; (vi) the general state of the economy; (vii) risk of future legal proceedings against the Company; (viii) the international operations of the Company; (ix) reduction in the Company’s backlog; (x) fluctuations in interest rates; (xi) fluctuations in currency exchange rates; (xii) upfront risk of time invested in participating in consortia bidding on large projects and projects being contracted through private finance initiatives; (xiii) limits under the Company’s insurance policies; (xiv) the Company’s reliance on distributions from its subsidiary entities and, as a result, its susceptibility to fluctuations in their performance; (xv) unpredictability and volatility in the price of common shares of the Company; (xvi) the degree to which the Company is leveraged and the effect of the restrictive and financial covenants in the Company’s credit facilities; (xvii) the possibility that the Company may issue additional common shares diluting existing Shareholders’ interests; (xviii) income tax matters. These risk factors are discussed in detail under the heading “Risk Factors” in the Company’s Annual Information Form. New risk factors may arise from time to time and it is not possible for management of the Company to predict all of those risk factors or the extent to which any factor or combination of factors may cause actual results, performance or achievements of the Company to be materially different from those contained in forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of May 5th, 2022.

The factors used to develop revenue forecast in this news release include the total amount of work the Company has signed an agreement with its clients to complete, the timeline in which that work will be completed based on the current pace of work the company achieved over the last 12 months and expects to achieve over the next 12 months. The Company updates these assumptions at each reporting period and adjusts its forward-looking information as necessary.

Definition of Non-IFRS Measures

Non-IFRS measures do not have a standardized meaning within IFRS and are therefore unlikely to be comparable to additional measures presented by other issuers. In commentary and tables within this document IFRS measures are presented along with non-IFRS measures. Where non-IFRS measures are used, there is a reconciliation to IFRS amounts provided. Any changes in the definition of non-IFRS are disclosed and quantified.

Adjusted EBITDA1 for Bank Covenant Purposes

The Company believes that Adjusted EBITDA for bank covenant purposes, defined below, is an important measure for investors to understand the Company’s ability to generate cash to honour its obligations. Management of the Company believes that in addition to net income (loss), Adjusted EBITDA for bank covenant purposes is a useful supplemental measure as it provides readers with an indication of cash available for debt service, capital expenditures, income taxes and dividends. Readers should be cautioned, however, that Adjusted EBITDA for bank covenant purposes should not be construed as an alternative to net income (loss) determined in accordance with IFRS as an indicator of the Company’s performance or to cash flows from operating activities as a measure of liquidity and cash flows.

The Company defines Adjusted EBITDA for bank covenant purposes in accordance with what is required in its lending agreements with its senior lenders.

References in this Press Release to Adjusted EBITDA for bank covenant purposes are based on EBITDA adjusted for the following items:

- Gain/loss arising from extraordinary, unusual or non-recurring items, such as debt extinguishments

- Acquisition costs and deferred consideration revenue (i.e. restructuring costs, integration costs, compensation expenses, transaction fees and expenses)

- Non-cash expenses (i.e. grant of stock options, restricted share units or Capital stock to employees as compensation)

- Gain/Loss realized upon the disposal of capital property

- Gain/loss on foreign exchange translation

- Gain/loss on purchase or redemption of securities issued by that person or any subsidiary

- Gain/loss on fair valuation of financial instruments

- Amounts attributable to minority equity investments

- Interest income

Adjusted EBITDA for bank covenant purposes is not a recognized measure under IFRS and does not have a standardized meaning prescribed by IFRS, and the Company’s method of calculating Adjusted EBITDA for bank covenant purposes may differ from the methods used by other similar entities. Accordingly, Adjusted EBITDA for bank covenant purposes may not be comparable to similar measures used by such entities. Reconciliations of net income (loss) to adjusted EBITDA for bank covenant purposes have been provided under the heading “Reconciliation of Non-IFRS measures”.

Net Debt

Net debt is a non-IFRS measure that does not have a standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. The Company calculates net debt as the balance of the credit facilities, debentures and other financial liabilities less the company’s unrestricted cash.

Net debt as a multiple of adjusted EBITDA is determined as net debt as defined divided by Adjusted EBITDA (as defined above). There is no directly comparable measures for Net debt as a multiple of Adjusted EBITDA. Net debt as a multiple of Adjusted EBITDA is quantified under the heading “Capital Management”.

Working Capital

Working Capital is a non-IFRS measure that does not have a standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. The Company use working capital as a measure of assessing overall liquidity and is calculated by subtracting current liabilities from current assets. There is no directly comparable IFRS measure for working capital. Working capital is quantified under the heading “Liquidity and Capital resources”.

Working Capital Measured in Number of Days of Gross Billings

Included in working capital of the Company are amounts reflecting project costs and sub-consultant expenses. The Company only reports its net fee volume as revenue, which would not include the billings for the recovery of these incurred costs. Therefore, to measure number of days outstanding of working capital, the gross billings, which include the billings for recovery of project expenses, would result in more consistent calculations.

The information included is calculated based on working days on a twelve-month trailing basis, measured as days outstanding on gross billings, which is estimated to be approximately 30% greater than net fee volume.

The Company believes that informing investors of its progress in managing its accounts receivable, contract assets and contract liabilities is important for investors to anticipate cash flows from the business and to compare the Company with other businesses that operate in the same industry. There is no directly comparable IFRS measure. Working capital measured in number of Days of Gross Billings is quantified under the heading “Liquidity and Capital resources”.

Billing from Recurring Software Support and Maintenance

The amount of recurring software support and maintenance gross billings represents the annualized invoice amount the Company is able to charge clients and is recognized to revenue in accordance with the Company’s accounting policy through the movement in the accounts receivable and contract assets balances in the statement of financial position. There is no directly comparable IFRS measure.